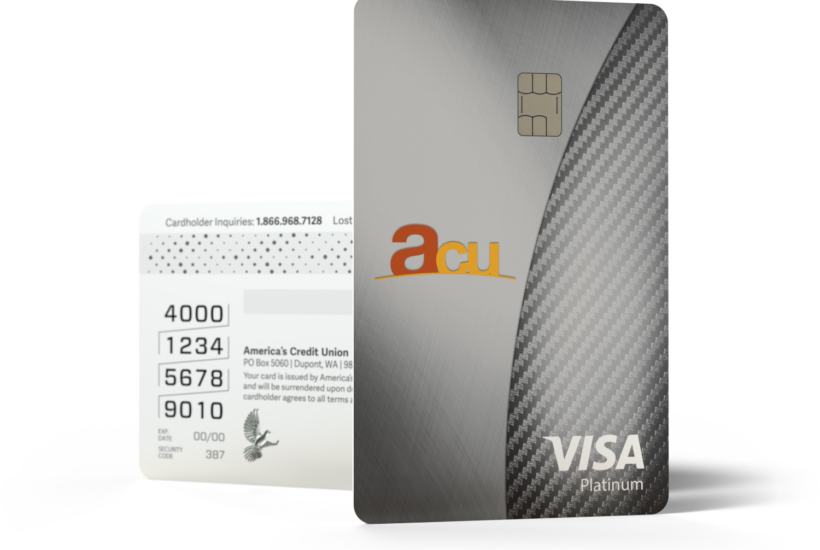

ACU Platinum Visa Credit Cards

With our lowest rate and no fees, it’s everything you need and nothing you don’t want!

Our ACU Visa Platinum Credit Card offers a streamlined credit card experience with our lowest variable rate on new purchases and a super low rate on balance transfers.

Benefits of an ACU Visa Platinum Credit Card

A Visa Platinum Credit Card from America’s Credit Union is the best choice if you want an affordable, no-frills, no-fuss credit card with dedicated local service!

![]()

Lowest Rate on Purchases

Enjoy our lowest variable APR on new purchases so you can live life without worry or stress.

![]()

Low Intro Rate on Transfers

Transfer your high-interest balance and enjoy a super low rate for 180 days.

![]()

Digital Banking Services

Use Online and Mobile Banking, Digital Wallet, and our Card App to easily manage your funds.

![]()

No Annual Fees or Charges

Always stay on top of your finances with no hidden fees and helpful member services.

Visa Platinum Credit Card Rates

Our ACU Visa Platinum Credit Card features an incredibly low interest rate so you can buy the things you want and pay for the things you need.

More Advantages of an ACU Visa Platinum Credit Card

![]()

24/7 access with Online and Mobile Banking

![]()

ACU Card App to set up alerts and controls

![]()

Digital Wallet including Visa Checkout

Personalize Your ACU Visa Platinum Credit Card

Why settle for the standard-issue card when you can add a favorite image to your credit card for a small fee? Add personalized images to your card for just $15!

1.54% APR Balance Transfers

Transfer high-interest balances from other financial institutions and save! Enjoy a super-low, 1.54% APR, interest rate for six months on balances transferred within 30 days of account opening! **

Consolidate your different card balances into one low payment on your ACU account at a great rate.

ACU Visa Platinum Credit Card FAQs

-

Q: Do I need to be a member of ACU to get this card?

-

A: Yes, and you should join us today to enjoy many perks besides this card. When you join ACU, you’re joining a family. You get great benefits and outstanding financial products. Plus, it’s easy to join. You can even do it online.

-

Q: Do I need excellent credit to get this card?

-

A: No, you don’t need excellent credit but higher credit scores get lower rates.

-

Q: What is the interest rate on this credit card?

-

A: The ACU Visa Platinum Credit Card comes with a variable rate of 10.54% to 18.00% depending on your creditworthiness.

The balance transfer rate is 1.54% for 180 days. -

Q: How does a balance transfer work?

-

A: After you are approved for your credit card, you need to let us know as soon as possible that you plan to use your card to transfer the balance of one or more credit cards from other credit card issuers.

Next, you give us the details of your other credit card accounts and issuers. We will pay off your balances for you and you will start making payments on your new ACU credit card with a lower interest rate than your old cards. If you plan to close your old credit card accounts, make sure you first pay off any outstanding purchases, interest charges, and fees.

For best results, you should aim to pay down your transferred balance within 180 days when you can benefit from our low introductory interest rate. Try not to add any new purchases to your account until you have significantly paid down your debt.

-

Q: What security features are available with an ACU credit card?

-

A: Verified by Visa enrollment is no longer required on ACU cards, but rest assured that your ACU Visa card transactions are still secure. Your security is important and that’s why we’ve deployed advanced risk detection technology to monitor transactions. This removes the need for passwords, allowing you to shop without interruption.

Your card is protected by EMV security chip technology and you can set up purchase alerts using the ACU Card App.

-

Q: What Digital Wallet and mobile payment services can I use with my ACU credit card?

-

A: Your ACU Visa Platinum Credit Card is compatible with:

★★★★★

“I have been an ACU member since 2012. My accounts have included a business account, personal account, credit card, and vehicle loans. Over the years, I have always been greeted with enthusiasm and a helpful attitude. Ms. Lydia and Zach have been available to answer any questions I’ve had. I am proud to say I’m a member of the DuPont Branch America’s Credit Union and often recommend their branch and staff to family and friends.”

– Lou M.

Ready to Apply for an ACU Visa Platinum Credit Card?

If you’re looking for a hassle-free credit card with extra low rates, your search ends here. Our ACU Visa Platinum Credit Card is a simple, secure solution to your financial needs.

More ACU Credit Card Options

We have a credit card to suit every lifestyle. Whether it’s our Platinum Rewards card, Green Card, or Business Card, we’ve got something for everyone.

ACU Platinum Rewards Card

The ACU Platinum Rewards Visa is the perfect card when you want a low rate, rewards, and a rich assortment of benefits.***

ACU Green Card

This credit card is especially for people with less than perfect credit. Enjoy cash-back rewards, with no annual fee, and a competitive fixed APR on new purchases.

ACU Business Credit Card

The ACU Business Credit Card features a low fixed rate, cash back, security, local service, and strong benefits so you can stay ahead and keep growing.

*APR=Annual Percentage Rate. Your APR for purchases is 10.54% – 18.00% based on your creditworthiness and will vary with the market based on the Prime Rate. This transaction is subject to credit approval. See full Visa disclosure or Business Visa disclosure for more information.

**Balance Transfer Disclosure: Offer applies only to balances transferred with cash advances done by America’s Credit Union (ACU) to pay off existing balances with other creditors. There is no grace period for balance transfer transactions; interest is charged from the date of posting. Business Visa is excluded from this promotion. We apply your minimum payment to balances with the lowest APRs first. Amounts paid over the minimum payment will be applied in the order of highest to lowest APR balances. Your other debt account(s) will not be closed by ACU (even if you transfer your entire balance). If you wish to close other accounts, please contact the creditor. You should make at least your minimum payment on any card on which you are transferring a balance until you receive confirmation from the creditor that your balance transfer payment has been received, ACU is not responsible for late payments on other debt account(s). In the event that your request(s) exceed the amount of your credit line, then ACU will fulfill your requests in numeric order as listed on your request. ACU may decline to process one or more requests and/or may complete one request in a partial amount.

***Cardholders will earn a one percent (1%) cash reward for every one dollar ($1.00) in net purchases (purchases minus returns/credits) made on your Credit Card Account, rounded to the nearest one cent ($0.01). You do not earn Cash Rewards on cash advances of any kind, balance transfers, any interest or fees, including but not limited to returned payment fees, and late fees. Your Cash Reward balance will be calculated monthly and a rolling total will appear on your Visa statement. Your account must be open and in good standing (not canceled or terminated by either party, not delinquent or otherwise not available to use for charges) at the time of redemption.